Remuneration

Remuneration policy for the executive management of AS Ekspress Grupp

1. Introduction

The remuneration policy describes the main principles of Ekspress Grupp’s remuneration of the Supervisory Board, committees and the Management Board, as well as the decision-making process complied with when approving, assessing, and implementing the remuneration policy. The remuneration policy is valid for up to four years. The remuneration policy will comply with the recommendations of the Estonian Securities Market Act (§ 1353), Corporate Governance Recommendations (clause 2.2.7) and the provisions of the Shareholders’ Rights Directive (EU 2017/828; Art 9b). The remuneration policy is based on the long-term goals of the Group and takes into account the financial results and the legitimate interests of investors and creditors. Compliance with the remuneration policy is monitored by the Supervisory Board.

2. General principles

The mission of Ekspress Grupp is to serve democracy. In accordance with our strategy, Ekspress Grupp builds sustainable growth by being part of the opportunities presented by the digital transformation. The objective of the Group is to increase shareholder value through revenue growth and improved profitability. Ekspress Grupp is developing and expanding its media business and seeking growth opportunities in new digital media or media-related businesses. The Group’s remuneration policy is aimed at promoting the long-term financial success, competitiveness, and creating shareholder value.

The Group aims at using reasonable, well-balanced and competitive remuneration packages to attract and retain talented employees who are the key to our business.

The remuneration of employees across the company is reviewed regularly to secure its competitiveness in the context of market and to attract and retain talent. To avoid conflicts of interest, remuneration is managed through well-defined processes, ensuring that no person is involved in the decision-making process regarding his or her own remuneration.

The remuneration policy is submitted to the AGM for adoption at least once every four years, as well as when significant changes are made to the remuneration system.

3. Remuneration of the Supervisory Board and Committee Members

Decision-making process

The remuneration of Supervisory Board is approved by the shareholders at the AGM. The members of the Supervisory Board or Management Board are not employed by the company.

Remuneration

The Chairman of the Supervisory Board receives remuneration. The other members of the Supervisory Board do not receive any remuneration unless the AGM decides otherwise. No other fees are paid to the Supervisory Board members or Chairman for the participation in the work of the committees.

4. Remuneration of the Management Board members

Decision-making process

The Supervisory Board is responsible for preparing the remuneration policy for the Management Board. To ensure that these principles are used for the intended purpose, the Supervisory Board prepares and proposes amendments to the remuneration policy. The Supervisory Board decides on the remuneration of the Management Board members and other terms and conditions of the Management Board members’ contracts of employment.

The Supervisory Board may temporarily deviate from the remuneration policy in case of significant changes in the Group’s structure and business operations or changes in the legislation regulating remuneration, as well as in any other case where the deviation is significant for ensuring the Group’s long-term interests and continuance as a going concern.

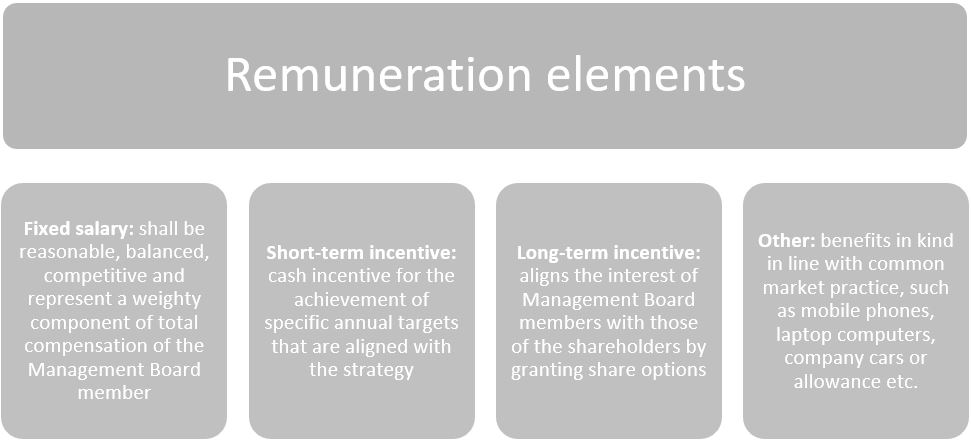

Remuneration elements

The remuneration of the Management Board is comprised of the following elements:

- a fixed salary;

- a short-term incentive paid annually in cash;

- a long-term incentive in the form of shares;

- other benefits.

Fixed salary must be reasonable, balanced, competitive and represent a weighty component of total compensation paid to the Management Board member. The Supervisory Board may revise and change the amount of fixed salary during the term of the contract. Changes in salary are determined based on business results, changes in the Management Board member’s liability, individual contribution, the general market level and the comparative data of the respective position in the market.

A short-term incentive package consists of up to 6 month basic remuneration plus project-based one-off incentive payments approved by the Supervisory Board. Performance measures and targets for short-term incentives are set by the Supervisory Board on an annual basis. Annual targets are in line with the Group’s strategic objectives and may include, among others, profitability, sales revenue, cash flow or performance indicators, etc. The goals and their share may vary from year to year, reflecting the Group’s priorities. After the end of each year, the Supervisory Board reviews the fulfilment of the goals by the Group’s Management Board and determines the extent to which each goal has been achieved in order to determine the final amount of a bonus payment. The annual bonus is paid out at the beginning of next year on the basis of audited annual results. The Group has the right to reduce the bonus payable to a member of the Management Board depending on the financial results or transactions, to suspend the bonus payment or to demand partial or full refund of the bonus already paid out if:

- general financial results of the Group have significantly deteriorated compared to the previous period;

- the Management Board member does not meet the performance criteria; or

- the bonus has been determined on the basis of data that was found to be materially inaccurate or incorrect.

Long-term incentives are based on share option programmes by granting the shares to the Management Board members. Share options are granted in accordance with valid share option programmes. Shares can be exercised after 3 years from signing of the share option agreement. Share-based remuneration promotes the alignment of interests and thus creates value for the shareholders. The three-year performance period is used as it clearly links the remuneration with the market value of the share, and ensures the implementation of the Group’s digital transformation strategy.

The Management Board contracts are typically concluded for the duration of 5 years. The maximum severance pay is capped at 6-9 months of basic remuneration. The non-compete clause and provisions governing reduction in the severance pay normally apply during the severance pay period.

Ekspress Grupp remuneration report 2021

Ekspress Grupp remuneration report 2022